In 2023, when the overall growth rate of the new energy vehicle market slows down, extended-range electric vehicles, as a dark horse in the sub-category, have run out.

Industry data shows that from January to August this year, the cumulative sales of domestic extended-range passenger cars were 314,000 units, a year-on-year increase of 159.08%. In contrast, the growth rate of pure electric vehicles is about 2 digits.

The explosive extended-range car has also leveraged the original high-concentration battery matching pattern.

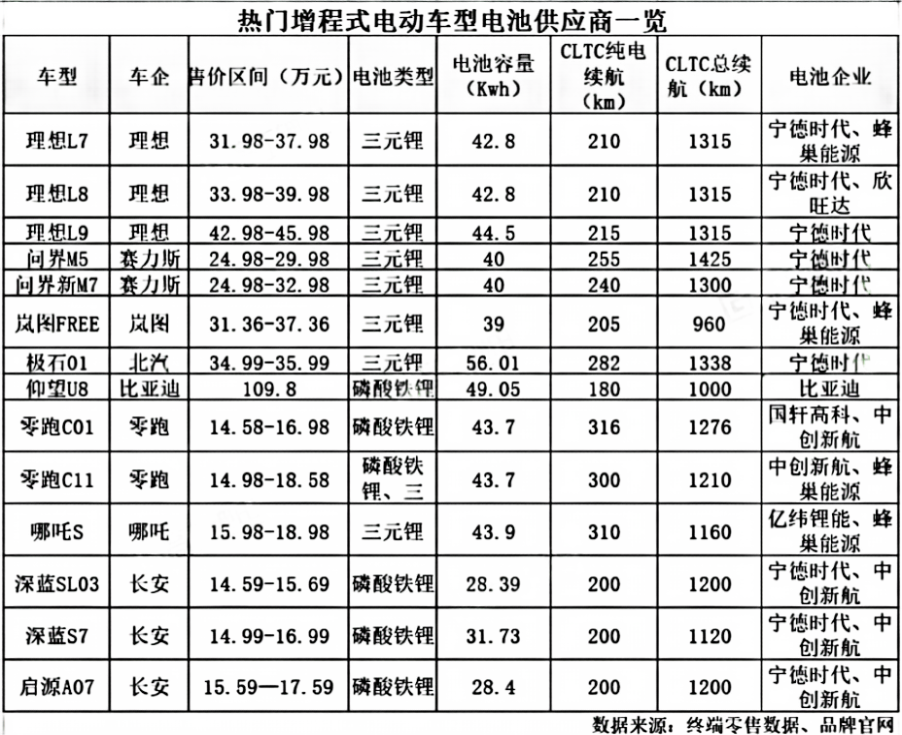

According to Gaogong lithium battery combing, among the 14 hot-selling range extension models on the market, only 5 models have chosen a single power battery supplier, and 9 models have adopted a diversified supplier strategy. For example, Li Auto expanded its battery supplier pattern from CATL to Hive Energy and Sunwoda.

At the same time, with the increase in the number of extended range models, the degree of differentiation is also increasing, such as the price from the mid-to-high-end range of more than 200,000 yuan and 300,000 yuan to the cost-effective range of 100,000-200,000 yuan. Affected by this, car companies' choice of extended-range battery types has also begun to shift from ternary lithium to lithium iron phosphate.

Some analysts predict that the extended range market is expected to exceed one million units in 2024, with a market share of 4.05%. This means a new round of opportunities for battery companies that need to optimize production capacity and improve capacity utilization.

A range extension model that should not be underestimated

The extended-range hybrid car, nicknamed "carrying a large charging treasure", is equipped with both a generator and an engine inside, just like plug-in hybrid cars. However, the extended-range engine does not directly drive the vehicle, but is limited to powering the battery when it runs out.

Therefore, compared with plug-in hybrid vehicles, range extender only needs to add the range extender of the engine to the electric motor, without adding an engine drive system, which is less costly. Compared with pure electric vehicles, extended-range vehicles reduce the mileage anxiety of car owners and are an important force for new energy vehicles to open up market share.

Although there has always been a fierce controversy over "backward technology" and "caring for users" in China, before the results of this verbal dispute, car companies that chose the extended range route had proved themselves "correct" with sales data and profit performance.

Taking Li Auto, a representative car company, as an example, terminal retail data shows that in September this year, Li Li set a new high in monthly delivery, with new car deliveries reaching 36,060, a year-on-year increase of 212.7%; In the first three quarters, the ideal cumulative delivery volume has reached 244,200 units. The three models of L7, L8 and L9 have all delivered more than 10,000 vehicles for two consecutive months.

In addition to the sales figures, the importance of extended-range trams is also reflected in their impact on the company's performance. Dominated by its low-cost characteristics, Li Auto took only 7 years to go from car manufacturing to profitability, compared with BYD and Tesla in nearly 20 years. In the second quarter of 2023, Ideal achieved profitability for three consecutive quarters, and gross margin reached 21.8%, which has exceeded Tesla's 18.2%.

For second- and third-tier car companies, extended-range models are an important sustenance for starting the battle of turning over.

AITO, which also mainly promotes extended-range models, asks

Address:No.15 Xingtai North Road, Hailing District, Taizhou City, Jiangsu Province, China

Hotline:0086-17712702588(Beijing time) 9:00-18:00

E-mail:james.zou@ecexspower.com