Strongly optimistic ", when asked how to view the development prospects of new energy storage in the northwest region, an expert who has been engaged in the energy storage industry in the northwest for many years replied.

Deserts, gobi and desert areas in China are mainly distributed in Xinjiang, Qinghai Province, Gansu Province, Ningxia and Shaanxi, as well as Inner Mongolia across the "three north" region. Wind energy and solar energy resources are abundant, and the technological exploitable amount accounts for more than 60% of the country. When many new energy bases are located in the northwest, driven by the policy of new energy distribution and storage, the development of new energy storage has also attracted a lot of attention.

From the operational data, it can be seen that the scale of energy storage in the northwest region is rapidly expanding, but from the utilization situation, it is still common for energy storage power stations to be built without use. Several industry experts have stated that the development of new energy storage requires system level optimization, avoiding blind development, and following the development plan of the power system. The scale, layout, timing, and utilization goals of new energy storage development should be scientifically determined to better meet the needs of the power system.

Double the scale, double it again

The energy storage installation data of various provinces and regions in the northwest are constantly being updated. According to the disclosure of State Grid Ningxia Electric Power Company, in February 2023, the grid side energy storage capacity of Ningxia reached 1.13 million kilowatts/226 million kilowatt hours, surpassing one million kilowatts in the country and ranking first in the country. Ningxia Electric Power Company predicts that by the end of June, the energy storage capacity in Ningxia will reach 1.52 million kilowatts/30.4 million kilowatt hours.

Industry insiders lament that "Ningxia was still unknown at the beginning of 2022, and by the end of the year, it had concentrated its efforts to become the number one in the country". It is understood that although a considerable number of regions have introduced mandatory allocation and storage policies, some places have not strictly implemented the rule of not being connected to the grid without allocating energy storage. Ningxia has strictly implemented the rule of new energy allocation and storage. Therefore, in 2022, a batch of energy storage projects were completed and put into operation before the end of the year, promoting the rapid growth of energy storage installation.

In April, the Energy Regulatory Office of Gansu Province announced that as of the end of March 2023, 35 new energy storage projects had been completed and put into operation in Gansu, with a total installed capacity of 615000 kW/1323000 kWh. By May, the State Grid Gansu Electric Power Company had refreshed the data and announced that the grid connected capacity of Grid energy storage's energy storage capacity exceeded one million kilowatts on May 20, reaching 1.01 million kilowatts/2.14 million kilowatt hours.

Behind the high growth is the operation of large energy storage power plants. On May 20th, the first grid side shared energy storage power station in Gansu Province, the 330kV Jianhang Energy Storage Power Station, entered trial operation. The first phase of construction has a scale of 150 MW/300 MWh, which is currently the highest grid connected energy storage power station in China.

Among the top ten provinces (municipalities, autonomous regions) with newly added electrochemical energy storage power stations in operation in 2022, four out of the five provinces in the northwest are listed.

The development goals of new energy storage in the northwest provinces are at a high level nationwide. Gansu and Qinghai provinces have proposed to achieve a new installed capacity of 6 million kilowatts by 2025, while Ningxia has a goal of 5 million kilowatts. This means that compared to their current scale, these regions will achieve growth of 5 to 10 times or even more in the next three years.

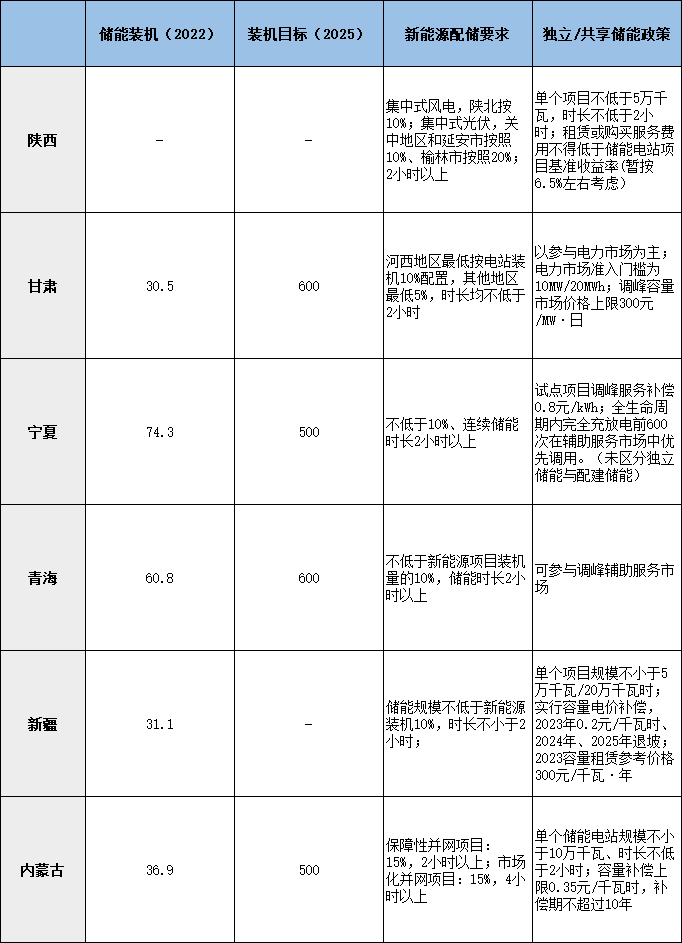

Overview of Energy Storage Development in the Five Northwest Provinces and Inner Mongolia (Unit: 10000 kW)

Data source: Public information

Dissipation and Delivery Anxiety

Behind the rapid growth of energy storage is the great development of new energy, and increasing flexible regulation of resources is a common demand in areas with a high proportion of new energy, including the northwest region.

At present, the National Development and Reform Commission and the National Energy Administration have issued a list of three batches of large-scale wind power and photovoltaic base construction projects with a focus on deserts, Gobi, and desert areas. The first batch has a scale of about 100 million kilowatts, the second batch has a scale of about 455 million kilowatts, and the third batch of project lists are gradually being announced.

As the proportion of new energy increases, the difficulty of peak shaving and electricity balance guarantee increases, and the difficulty of ensuring electricity security increases. In addition, the high proportion of flexible access to new energy and the impact of large-scale new energy power transmission on system stability are all challenges faced by the construction of new power systems in the northwest region.

Taking Qinghai as an example, the overall external communication and support capabilities of the Qinghai power grid are relatively weak, making it a relatively independent power grid form. The problem of new energy consumption and direct current transmission in Qinghai Province is prominent, and the development and application of energy storage are necessary solutions.

By the end of the 14th Five Year Plan period in Qinghai, the installed capacity of new energy will reach 63.63 million kilowatts. The large-scale grid connection of new energy has led to prominent peak shaving issues in the power system. To ensure the consumption of new energy and the safe and stable operation of the power system, comprehensive measures such as load side response, external electricity trading, the second ultra-high voltage construction, and new energy+condenser have been taken to ensure a high utilization rate of new energy, while improving power supply guarantee capacity and reducing electricity The electricity shortage requires an additional 9 million kilowatts of energy storage. After all these energy storage facilities are completed, they can promote a 9.6% increase in the utilization rate of new energy.

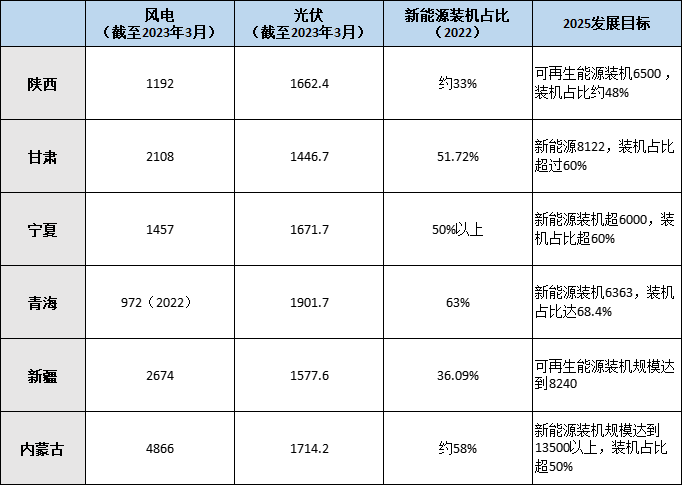

New Energy Installation Data for the Five Northwest Provinces and Inner Mongolia (Unit: 10000 kW)

Data source: Public information

In fact, with the increasing pressure of new energy consumption, the requirements for the continuous charging and discharging duration of electrochemical energy storage in the northwest region are also increasing. For example, the latest policy in Xinjiang stipulates that the scale of a single shared energy storage power station project should not be less than 50000 kW/200000 kWh, that is, the energy storage duration should reach at least 4 hours.

In addition, pumped storage is also expected. Currently, there is no Pumped-storage hydroelectricity in the northwest power grid. During the "14th Five Year Plan" period, Shaanxi will have 13 pumped storage stations included in the list of key implementation projects, with a total installed capacity of 15.45 million kilowatts. There are 10 pumped storage projects in Qinghai included in the national "14th Five Year Plan" for pumped storage approval, with a total installed capacity of 17.9 million kilowatts. The resources of Pumped-storage hydroelectricity that can be developed in Xinjiang have reached 36.6 million kilowatts, of which 13.8 million kilowatts are key projects to be implemented during the 14th Five Year Plan period. Several Pumped-storage hydroelectricity have also started construction in Gansu and Ningxia.

How to use energy storage

As more and more new energy storage power stations are landing in the northwest, how to fully leverage the role of energy storage power stations has become an important challenge. Although major new energy provinces generally show a strong demand for energy storage and various flexible regulation resources, the situation of energy storage facilities being "built without use" is relatively common. Energy storage has not played its expected regulatory role, and investors are unable to obtain profits, which makes the mandatory allocation and storage policy of new energy controversial.

There are usually different methods for supporting energy storage in new energy power stations, such as self built and shared leasing. Due to the poor utilization of self built energy storage, larger scale and higher voltage level shared energy storage has received more market and policy support.

Ensuring the number of calls is a common way to improve utilization. When Ningxia carried out the pilot of the 2022 new energy storage project, it was stipulated to provide peak shaving compensation for the pilot project. The first 600 charges and discharges during the entire life cycle will not be considered for price ranking in the auxiliary service market and will be prioritized for use. In May 2023, the Xinjiang Development and Reform Commission issued a notice on the establishment and improvement of supporting policies for the healthy and orderly development of new energy storage. In principle, the independent energy storage projects in the four regions of southern Xinjiang will be fully charged and discharged no less than 100 times in 2023.

Gansu Province mainly creates application space for energy storage power stations through the electricity market. According to current market rules, Gansu's new energy storage power stations can participate in the spot electricity energy market and auxiliary service market. In the electricity auxiliary service market, independent energy storage stations can participate in the frequency regulation market and peak shaving capacity market. At present, the peak valley price difference in Spot market of Gansu Province is about 0.35 yuan/kWh. In terms of capacity income, Gansu Province will bring new energy storage into the peak shaving capacity market, recover part of the Fixed cost through capacity compensation, and the upper limit for declaration and settlement of the peak shaving capacity market is 300 yuan/MW · day.

After the grid connected Zhongneng Blongi Energy Storage Station (60MW/240MWh) was put into operation in 2020, the main source of revenue was the electricity auxiliary service market. Due to the small number of energy storage stations in the market at that time, the frequency modulation revenue was considerable. In 2022, Gansu will include new energy storage in the spot market rules, and Bulongi Power Station has now participated in the power Spot market.

According to the eo, in provinces and regions where the Spot market operates, such as Gansu and Guangdong, many power industry practitioners believe that participating in the power market is the ultimate way to give play to the value of energy storage and achieve reasonable returns. At present, the Spot market of electric power in northwest provinces and regions is under construction. As one of the first batch of pilot provinces for Spot market of electric power, Gansu has entered the stage of continuous long-term operation of spot market. Shaanxi Province carried out short-term simulation test runs at the end of 2022, and Qinghai, Ningxia, and Xinjiang also successively promoted simulation test runs or power adjustment test runs in 2023. In the future, energy storage is expected to participate in Spot market price arbitrage in more provinces and regions.

Qinghai has designed a unique route. In 2022, State Grid Qinghai Electric Power Company proposed the "four unified" energy storage construction work plan, which includes unified planning, unified construction, unified scheduling, and unified operation. The plan is funded by new energy enterprises, and the provincial electric power company is responsible for the construction and unified scheduling management.

Public information shows that the Hongliu 225MW/900MWh energy storage power station in Haixi Prefecture has completed the EPC general contracting bidding for the project in early 2023. This is the first project of State Grid Qinghai Electric Power Company to promote the "four unified" planning and construction of electrochemical energy storage in Qinghai. However, according to EO's understanding, the progress of the "Four Unifications" development model has not been smooth, and the willingness of new energy enterprises to participate is not high.

Energy storage practitioners in the northwest region have expressed that the "four unifications" help fully utilize energy storage value in the power system. However, new energy enterprises are mainly responsible for funding, and construction and operation are led by power grid companies. New energy enterprises lack autonomy, making it difficult to promote.

At present, China's energy storage industry has entered a new stage of large-scale development, and in this context, 100 megawatt level energy storage projects have become the norm. In 2022, more than 20 100 megawatt level projects will be put into grid operation, and the planned number of 100 megawatt level projects under construction will reach over 400. From the perspective of regional distribution, the 100 MW projects are mainly distributed in western provinces such as Ningxia, Xinjiang, Gansu, Inner Mongolia, etc; From the perspective of driving factors, the large-scale development of energy storage in the western region cannot do without the rapid growth of new energy installation; From the perspective of supporting policies, Xinjiang, Ningxia, Gansu and other regions have proposed a series of innovative measures for the participation of new energy storage in the electricity auxiliary service market. The western region, especially the northwest region, has become the forefront of large-scale energy storage development.

The trend of energy storage development has become increasingly strong, but in the past two years, problems such as low utilization rate caused by the strong allocation of new energy for energy storage, profit model of energy storage power stations, and safety of large-scale energy storage have also been exposed. In order to welcome the new stage of large-scale energy storage, the 8th Energy Storage Western Forum jointly organized by the China Energy Research Association and the Zhongguancun Energy Storage Industry Technology Alliance will be held in Xi'an from August 1 to 3, 2023.

With the theme of "focusing on the new mechanism of the power market and improving the large-scale operation efficiency of energy storage", this forum has set up eight special forums and exhibitions, and the report covers many aspects, such as the joint operation and dispatching of new energy+energy storage, the independent sharing of energy storage development and practice, the participation of energy storage in the construction of the power market, large-scale Energy storage and solutions, and the application of long-term Energy storage in large-scale energy storage, It covers three levels: market mechanism, technology and solutions, and application market.

Address:No.15 Xingtai North Road, Hailing District, Taizhou City, Jiangsu Province, China

Hotline:0086-17712702588(Beijing time) 9:00-18:00

E-mail:james.zou@ecexspower.com